Built for your needs.

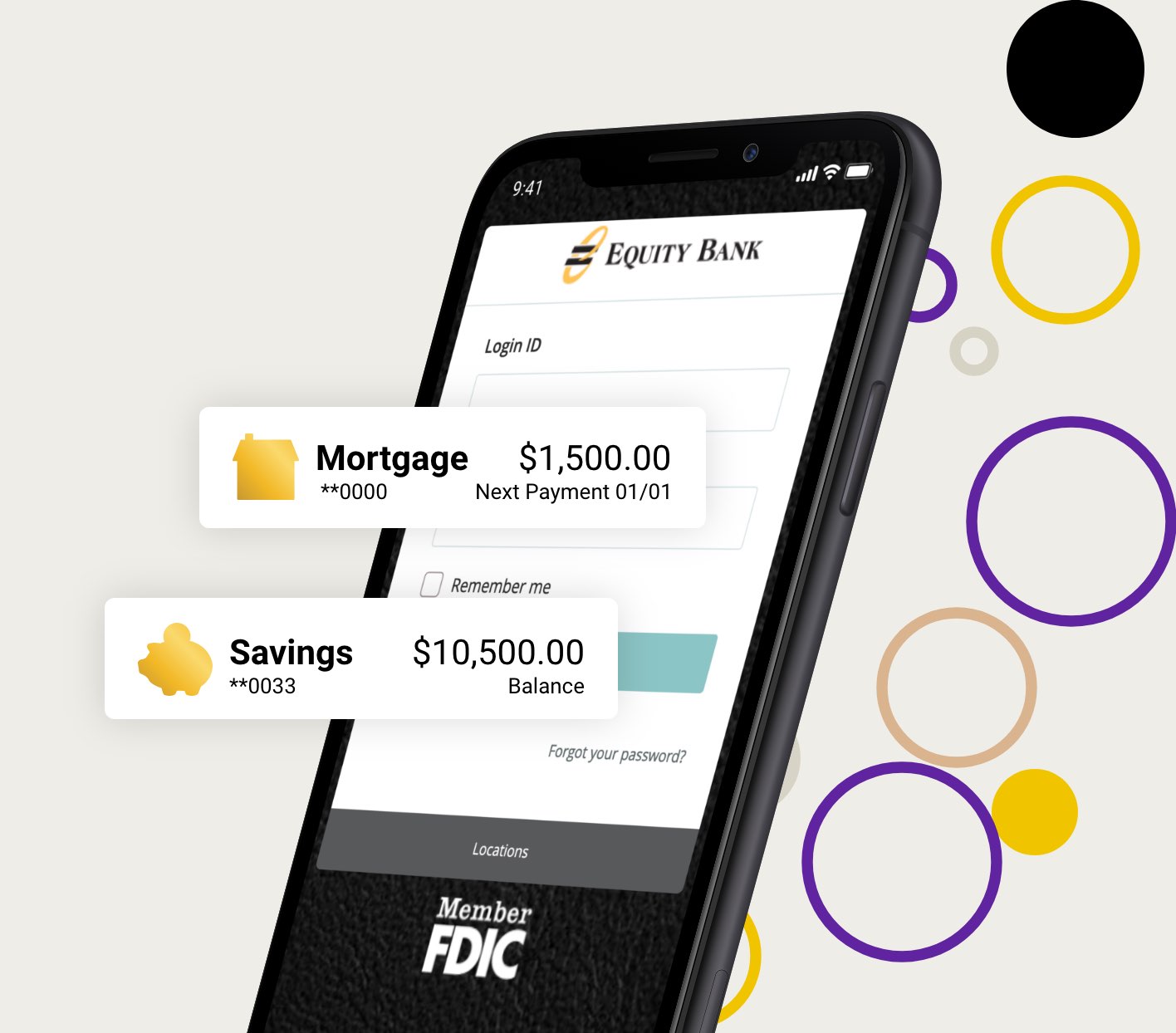

Banking you and your family can trust. Digital banking options, checking accounts with perks, and all that Equity Bank has to offer. No ATM fees, real-time and real-fast mobile banking, and more. Bank Like Anything’s Possible.

Open and Fund a New Account