Business

“Equity Bank rose to the occasion and met the needs of locally-owned small businesses. Equity is staffed by unrecognized super heroes at all levels. ”

– Randi Kay Graham, SEVA Beauty

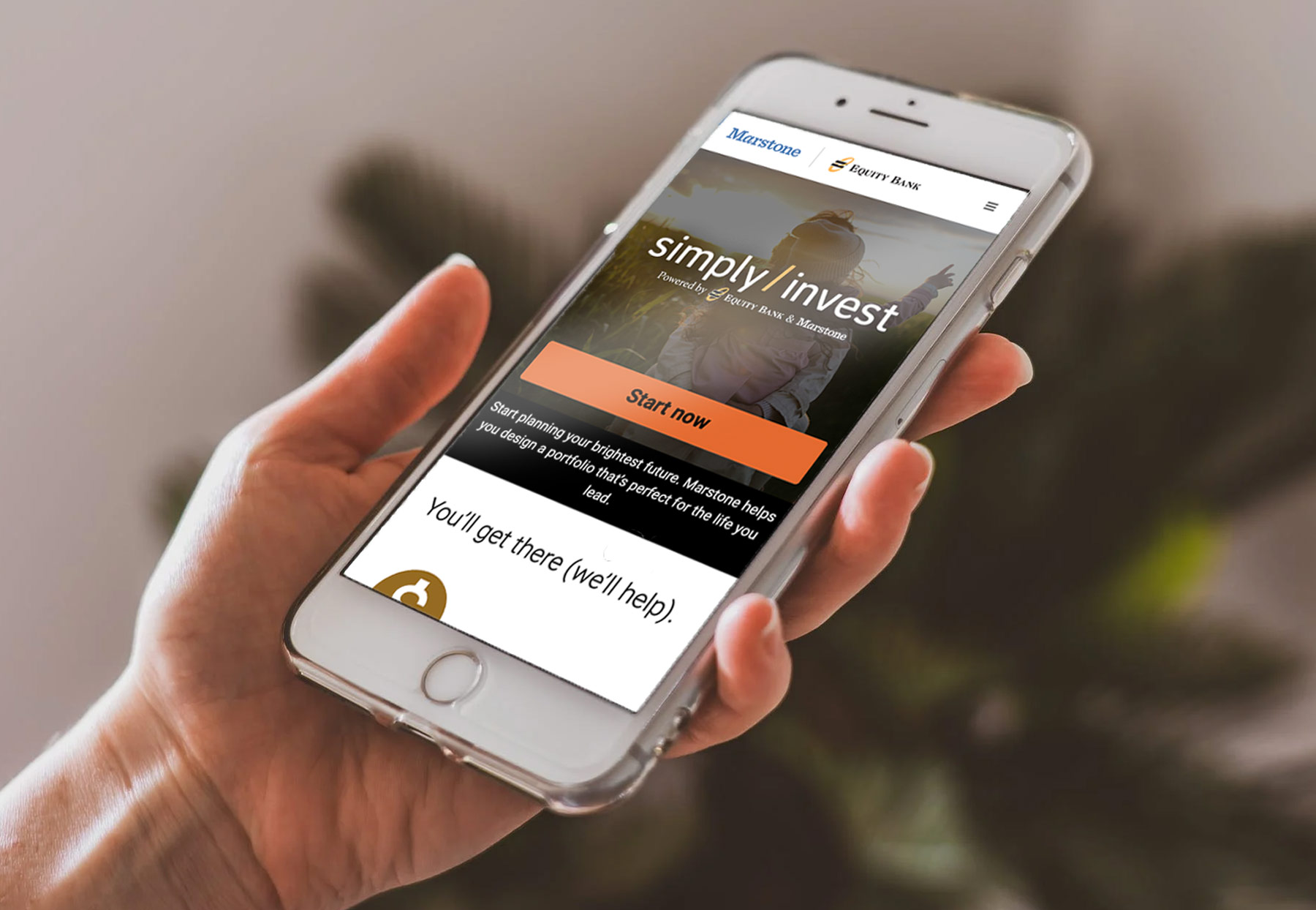

A low-threshold, digital investing platform designed for everyone.

New customers can receive a $300 bonus when you open a new Checking and Savings Account.

Personal

Spend, save, borrow, invest and protect your money with Equity Bank. Our personal banking services help set you up for success.

Open An Account